Company analysis

Sri Rejeki Isman is the biggest

integrated garment industry in indonesia. The company produces garment, fabric,

yarn and greige in its factory at Surakarta city and Semarang city. It is an

export oriented corporation which exports its product to many countries across

the world.

The company established in Solo

in 1966, it was a traditional trading company which was selling its product in

Klewer traditional market. Afterwards, the company established its factory

which is operating 4 production lines; those were spinning, weaving, finishing

and garment sections in 1992. The corporation produces four types of products,

it consists of yarn, fabric, garment and greige.

In 1994 the corporation was

successful in getting contract of new client for production of military uniform

for German army and NATO. Sri rejeki isman puts marketing representatives at

many countries such as Australia, germany, UAE, Hongkong, Singapore and USA.

The corporation implements unique

strategy in selling the product to customer, they used multi product, multi

customer and multi countries. The corporation is able to produce 18 million

pieces of garment product per year.

The company was surviving in

monetary crisis in 1998 because it has created garment market at oversea. At that time many garment corporations were

bankrupt due to high foreign exchange rate and low demand in domestic market. Garment

industry is cyclical sector, it is influenced by business cycle, and the

performance of its industry tends to be dropped in downturn economic.

To keep its position as market

leader the company has spent his fund to improve its facilities at factories,

it used digital printing machine. It also cooperated with reputable entity to

improve its fashion innovation. In 2015 the queen of Denmark and designer from

Denmark visited the factory.

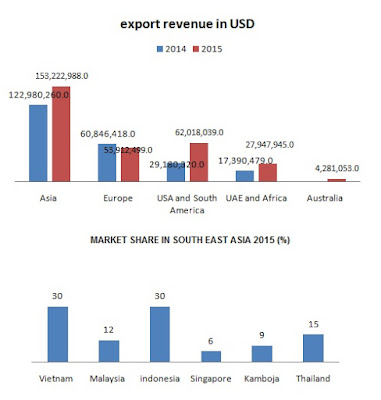

In 2015 sales increased 12.1 %

compared to sales in 2014. The double digit growth was contributed by

acceleration of export segment. Export of Garment segment to over sea, mostly

to USA and South America increased sharply in 2015. It increased 83.9 % than

garment segment in 2014.

The accelerated of revenue was

not in line with net profit margin that slightly decreased from 9 % in 2014 to

8.9 % in 2015. The fluctuation of raw material price was possibly as the

reason. As the result of that ROE and ROA were slightly decreased.