Co-Founder and key

success factor

I do not doubt that the key

driver of Tesla is at a one man show of the CEO and Co-Founder , Elon Musk. Elon manages the innovation of the tech

company in set up its Goal setting. Elon

has successful story in his former company Pay Pal, he was the co founder of

Pay Pal.Elon is also involved in space x. Company which is concerning in

advancement of rocket Tech.

Elon interest are in space, clean energy and internet. He thought himself

with computer programming when he was a child.

Elon is also supporting his

cousin clean energy business at Solar City. Solar City is the biggest solar

energy project in USA. Elon collaborates with solar city to support battery

equipment for Tesla's Vehicle. I think elon should move to Germany, the nation

with biggest solar energy production.

Business Model

The company applies an integrated

innovation in material science, internet and clean energy.

The company produces electric

power train system for major player in vehicle maker such as Toyota, BMW,

Mercedez Benz and Daimler. The company provides all spare parts and builds

supercharger network for charging at several cities, provide retail and service

center. The business model could engage the customer. The company is also

providing resale value guarantee for the customer to boost revenue with such

financing program.

The electric car which has been

produced is Tesla Roadster. The available models of roadster are model x and

model s. The car is built for premium segment because it is an electric sport

car.

Recent Condition

Tesla begins to produce vehicle

for major player company. I think Elon do different strategy in order to reduce

competition with major player such as Toyota or BMW. In 2013, Elon plans to

produce 40,000 vehicles, a sport sedan model for BMW. He decided to make partnership

with BMW.

The company starts to expand in Europe to sell the vehicle.

Key Financial term

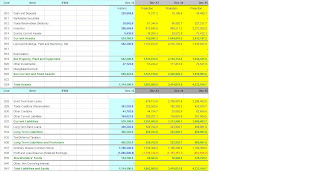

The company experiences losses in

several consecutive years since 2008 until 2012. This is a common condition for

start up company. The cash flow from operation and cash flow for investing are

negative. The company gets the fund from common stock and Long term debt for

financing the business.

The revenue in 2012 increase 159

% up compared to 2011. But i think the company has to check its aging

receivable and collecting the money ASAP if there is overdue payment. The

investor also has to check the sales contract because the inventory in 2012

increases 436 % up than the previous year but i think this is all right because

it is financed by 440 % of increase of account payable in 2012 compared to 2011,

an indicator of vehicle piled up in its warehouse.

The type of operational

management usually has big impact in cash to cash cycle. In operating lease

concept, the company records the vehicle at the balance sheet. The net

operating lease in 2012 is drop 14 % compared to 2011. This means the car order

may drop or there were many resale cars from customer.

The company faces higher competition

in high quality sport electric car segment, it is indicated with the decline of

profit margin since 2010 until 2012: 21,79 %, 19,80 % and 13 %. I think at the

next year the profit margin will be lower because they start act as vehicle

manufacturer for another company based in three years trend. BMW is doing its

branding strategy in sport electric car, they buy car from another manufacturer

then sell it with BMW as its Logo.

The company spend 6.89 % of its

revenue for Research and development cost. This was lower than the same cost in

2011 which is at 9 % of its sales. It seems the company start to reduce cost to

increase profit.

Outlook

Sport electric car may compete

with natural gas car. Tesla needs more capital to provide supercharger network

for the customer. Natural Gas increases in its production level, mostly in US.

in order to continue growth i think the company need to produce hybrid car.

Resale Value guarantee may be hooks the

company at the future. It represents that it doesn't confidence in electric

sport car.

The Revenue will increase at the

end of 2013 compared to the same period in 2012. The inventory increases

sharply almost fifth times bigger but it has been balanced with 5 times bigger on its account payable and the company also has high cash level, 18 % of its total asset in 2012. It

means supplier believe that Tesla will sell more and i will invest more in

supercharger network and service center. The working capital is negative means

that the company does new strategy in run the business. There are a certain

contract between supplier, Tesla and the corporate buyer.

| Asset | Sales | |

| 2008 | 51,699.0 | 14,742.0 |

| 2009 | 130,424.0 | 111,943.0 |

| 2010 | 386,082.0 | 97,078.0 |

| 2011 | 713,448.0 | 148,568.0 |

| 2012 | 1,114,190.0 | 385,699.0 |

| 2013 | 1,800,000.0 | 537,593.1 |

.jpg)

No comments:

Post a Comment