Macro economy

Gross domestic product of Indonesia

increase 6.5 % in 2012 compared to 2011. it means that indonesia has good

economic environment for investment. Despite the IDR currency rate continue to

drop to US dollar currency rate, and BI rate rises in recent year, several

industries still have good future to invest, include in real estate.

Real estate industry has steady growth;

in 2006 - 2010 the industry increases in the range 10% - 19% with average

growth at 14.32 %.

Instead of indonesia Central Bank

has implemented new regulation about Loan To Value which arranges the

collateral value in mortgage at 70 % (Bank Indonesia Circular No. 14/10/DPNP, dated 15th March 2012),

mortgage still increases in first quarter of 2013 at 47 % compared to the same

period in 2011. In 2010 real estate industry to total GDP is only 2.4 %, this

is lower than others country in south east asia such as malaysia and thailand.

For residential, jakarta has strong demand for

luxury apartment which is driven by corporate leasing and inbound business

trips from oversea. Apartment rent is projected to grow in the range 15%-16% in

2013, based on jones lang lasalle.

The real estate sector industry

is still promising in 2013.

Real estate industry

Real estate to GDP (%)

Real estate industry

Real estate to GDP (%)

Cowell Development Tbk (listed in Jakarta Stock Exchange)

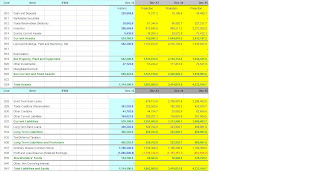

Forecasting

Based on sales the last 5 years I

conclude that the sales will increase 38.85 %, I used formula growth = (sales

of 2012 / sales of 2008)^0.25 - 1

The revenue will be affected by

inflation rate and interest rate. Real estate price in indonesia is growing

faster, the apartment price in jakarta increase 43 % in 2012 compared to 2011. Demand

for real estate is still higher than its supply, mostly in strategic and

favorite position. The interest rate

which is rising and the Loan To Value policy which is more conservative will

make real estate industry grows slower.

Project

The company has several real estate

projects, but the key driver of its high growth is westmark apartment at CBD ,

West Jakarta which has 71 % contribution of total revenue. Others project are

Melati Mass Resident and Serpong park residence. The company expanded to Borneo

island for its new project, it is named as Borneo Paradiso.

Benchmarking (2012)

Cowell

|

Alam

Sutra

|

Ciputra

|

|

Revenue

|

100.0%

|

100.0%

|

100.0%

|

Gross

Margin

|

45.4%

|

50.2%

|

60.0%

|

Interest

Expense

|

2.4%

|

21.4%

|

5.7%

|

Net

Income

|

22.4%

|

25.6%

|

49.7%

|

From the table at above I

conclude that cowell will still be growing and it needs more improvement. Its gross

margin is lower than other competitors and it is same with its net income. its interest expense is lower than others , in 2012 the company has just done acquisition of

subsidiary. The company may have low leverage cause have allocated more equity

in its capital structure.

.jpg)