Background

Indonesian economic in 2014 may

possibly be at down turn,

economic growth decline since 2012 -2013 which was at 6.3 and 5.8

consecutively. Accordance to bank mandiri, the economic growth of indonesia

will be at 5.1 in 2014. Based on data at the central bank, Economic growth of

third quarter is at 5.1 %.

The decline of economic growth

might be caused by the economic slow down of emerging market such as india and

china and also the hike of price level as government allocated fuel subsidy to

other sectors.

Government allocated its subsidy

for fuel and allocated it to several productive posts such as infrastructure

and also fund for social security.

The inflation rate will be rise

as the price of gasoline increases up. In other side Government spending will

be higher as the its allocation of subsidy to others sectors. The inflation

rate is predicted at 6.5 – 7.5.

In short run

Aggregate demand will decrease and real GDP will decline, in order to keep

better real GDP equal potential GDP, the allocation program has to be

implemented as soon as possible.

Meanwhile the fed will increase

its interest rate, the fed will reduce its money supply and they will sell more

Treasury bill. Foreign capital may be removed out from indonesia in huge

amount. The currency rate will be hit by the Fed’s policy which plans to rise interest rate in second quarter of next year.

Central Bank has increased

interest rate at 7.75 % to reach its target of inflatiion rate. That means the

central bank reduces the

currency in the market. The currency rate will be expected at stable exchange

rate to US dollar as the increase in interest rate of goverment bonds.

The positive news is the decrease

of Global oil price that is expected reducing cost for importing crude oil. Based on Bloomberg in November 2013,

oil price decline 30 %, demand of crude oil is slowing down and several

industries seems start to use substitute product such as natural gas, solar

energy,shale gas and

coal etc.

The weaken currency will be an

opportunity to increase export sector. As the source of various commodities

indonesia has opportunity to export commodity with cheaper price even though

the bank will rise interest. The strategic industry related to export oriented may need

lower financial cost to advance export. Government might give particular incentive such as tariff, quota and tax

in order to increase export as operational cost climbs driven because of

allocation of fuel subsidy.

Politics and Government

The government under president of Jokowi has

programs in agriculture, infrastructure and social security. Government plans

to build many water dams for plantation and farming and to open irrigation.

Another program is at maritime industry. The sector related to its sectors may increase significantly during

Jokowi administration.

The big concern is at the stability of politics

situation. As long as parliament still has either internal conflict or external

conflict there is no guarantee the politics circumstances will support the

economic situation. According to Bloomberg news, 38 % of government bond is

owned by investor from oversea that means rupiah exchange rate is likely affected

by investor from abroad who is sensitive to political situation.

Parliament is owned by the opposite parties as

they are the major part of parliament. The parliament plans to use its

interpellation right to ask the government about the allocation of fuel

subsidy. The politics situation may possibly be worse. Government needs support

from the opposite parties, as they power more than 50 % of votes.

Petrochemical Industry

Expert said that this sector as

the mother of industry because it contributes to give input to various

industries such as automotive, textile, food and beverage and etc. In

indonesia, petrochemical industry is still lack of investment because it needs

much more fund to establish integrated petrochemical industry such as

petrochemical refinery, olefin industry and etc.

Olefin as potential market

Olefin is the most demanded raw

material in petrochemical industry at Indonesia. Olefin could be extracted in

to various products such as polyethylene, polypropylene, styrene monomer and

etc. These products could be used to produce many kind of product in downstream

industry. These are plastic bags, bottles, food containers, automotive parts,

tires, synthetic rubber, fibers and filaments and others consumer product.

Although the demand of olefin

product has increased, the supply of chemical product is not able to capture

the opportunity. The upstream petrochemical industry is not capable yet in

serving domestic demand. There are two biggest companies in upstream industry

of petrochemical which produce olefin, Pertamina and Chandra Asri centre.

Olefin is a downstream product

which is having strategic value because of its derivative product is used in

many industries.

The stumble in enhancing olefin

production is the availability of naphta in indonesia. Naphta is a derivative

form of crude oil. 90 % of cost of production in producing olefin is spent for

purchasing naphtha. This is useful to breakdown the chain of hydrocarbon. In

almost every year indonesia Imports 2 millions tones of naphta for domestic

industry.

The lack of naptha supply for

olefin industry is caused by less investment in petrochemical refinery in

indonesia. The high demand of crude oil for fuel product and the decline of oil

reserve in indonesia are affected the supply of naphta. This circumstance

insists the industry player import the naphtha from another country. The cost

is very affected by the fluctuation of foreign exchange rate which is used to make

decision in investing fund for purchasing naphta.

In other side the industry is

also having problem in capacity of production, especially for ethylene and

propylene. The capacities of those are below the domestic demand. Its

capacities are 600,000 tones and 865,000 tones while the demands are 1.04

million tones.

In 2015, few companies will

increase the capacity of production; they are joint venture of pertamina - PTT

Global chemical and Chandra Asri Petrochemical.

Chandra Asri Petrochemical is the

only producer of ethylene, styrene monomer and butadiene in domestic. The

company is also one of two producer of polyethylene and one of three producer

of polypropylene in indonesia. Chandra Asri has 50 % market share for

polypropylene and has 30 % of polypropylene’s market share in domestic. (annual

report).

The opportunity in olefin

industry and its derivative product is still promising for investor because the

main player in its business is small in number and its capacity is under the

domestic demand.

CHANDRA ASRI PETROCHEMICAL

Strong Capital access

The company is established in 2011, it is new

company which was formed from a merger between two companies, Tri Polyta and

Chandra Asri. This is owned by several conglomerates group, they are salim,

ciputra and prayogo pangestu’s family,

The Majority shareholder is PT Barito Pacific

with 55.36 % of total share. The biggest contribution to sales is Polyolefin

product, which is at 50,86 %of total revenue.

The other products are Styrene Monomer, Olefin and Butadiene. 75 % of

total revenue is contributed from domestic market and the rest is from export.

The company also has strategic partnership with

international company such as Michelin for synthetic rubber production and Basf

for production license.

Capital Barrier to new

entry and high Plant Capacity utilization rate

The barrier for new entry in this industry is

huge investment amount for establishing the business. The company has big market share in

indonesia. Accordance to its annual report the company has used its capacity

almost 90 % in average. The demand in 2013 is still high and I think the

company will have strong demand in 2014 as the competition in olefin production

is low.

The average of capacity utilization is also high;

the demand in the market seems strong. The average of its utilization is 91.8

percent. The lack in this industry is limited supply of naptha, it is fully

imported from abroad.

Chandra Asri Petrochemical is the

only producer of ethylene, styrene monomer and butadiene in domestic. The

capacity of production is still below the domestic demand.

Global Oil price and

inflation rate

naptha as the main raw material of the company

declines in its price as the oil price decreases more than 30 % compared to the

previous years. The company may reduce its cost of goods sold and it is

expected increase profit. The decline of rupiah currency is expected exceed by

the decline of oil price. As long as wages do not highly increase, the downward

of oil price can be a good momentum to increase net income.

75 % of total revenue is contributed from domestic

market, which means the biggest income is in local currency. The energy price

is also higher caused by the allocation of oil subsidy by government; other

costs which hike are transportations.

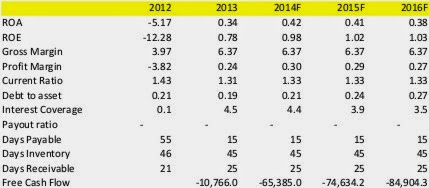

In 2013 the revenue has advanced 9.7 % up

compared to 2012. The company has expanded its business segment in butadiene

segment. The profit rises sharply and so did the gross margin in 2013 compared

to 2012.

The activity ratio is better in 2013 than

2012, with good market share and

low competition in domestic, the company will grow in the next 3 years.

My assumption, the sales will grow more tha 10 % as the inflation rate

advanced. The capacity of production is beneath the demand, the company should

add new factory or equipment to increase production.