Industry

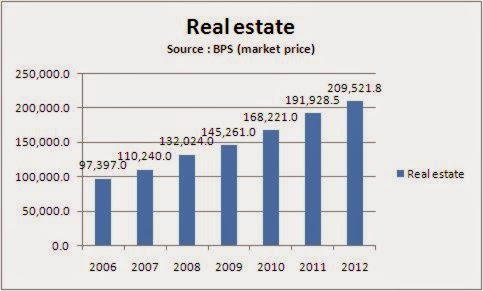

According to bps

in august 2014, the monthly average expenditure per capita for housing and

household facility in 2013 slightly increased about 7 % compared to 2012. The

demand for housing is still stable and the real estate industry continues to

grow larger. As the result of this, several company related to real estate

industry earns higher income, for example agung podomoro land, ciputra surya

and pakuwon jati.

Regulation: Low Loan to value ratio and high interest rate

In the early of

January, central bank announces its rate still stays at 7.75 %, the interest

rate for home financing is predicted as the same rate. In addition the bank

credit in September 2014 declines compared to September 2013. Despite high

interest rate and tight loan to value, the demand of real estate product and

property rent still advances.

Colliers International Asia real estate forecast of 2014 has a prediction that the office rent will increase 30 % up compared to 2013. The growth of office rent in 2013 was higher than 2014, it was at 37%. The decline in supply of office space was caused by lower exchange rate rupiah to us dollars.

Loan to value

regulation was revised with several points which tend to prevent investor to do

speculation in property investment. It charges lower loan to value ratio that

could force investor to spend more cash from own source.

Based data from

central bank in 4q2013, among of the projects of real estate companies are

financed by their internal cash. Bank loan is only financed 29 % of total

project. Higher interest rate of bank may not affect too much in the

sector.

In conclusion, real estate industry still

has good prospect as the demand of real estate is growing.

PWON – PAKUWON JATI

Share holder

The biggest share holder is public with 47

% of total share, the second and third consecutively is Burgami investment

limited and Pakuwon Arthaniaga.

Key driver

The key

successor of revenue growth in 2013 is kota kasablanka mall project. The

revenue in 2013 increased about 39 % compared to last year. According to annual

report revenue contribution of shopping mall and office rent are about 42 % of

total revenue. The second biggest contributor is hotel segment with 41 % of

total revenue in 2013.

The space rental

of office space and shopping mall are the main contributor, the company seems

concerning in development of superblock which provide shopping mall and office

in particular area.

The property

portfolio are kota kasablanka mall, tunjungan plaza I, tunjungan plaza

III,tunjungan plaza IV, east coast center, Gandaria city mall, tunjungan plaza

V and etc.

The company has

gross margin at 63.5 % of total revenue in 2013, it is better than gross margin

in 2012 which is at 62.2 % of total revenue. It is higher than 5 years average

gross margin which is at 48 %.

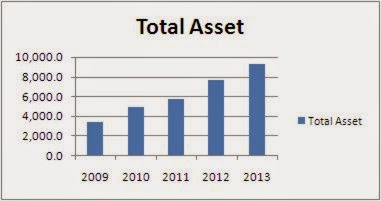

The company has

surplus of its cash flow from operation, in 2013 the cash to sales ratio is at

70.2 % which is higher than cash to sales ratio in 2012 which is 60.7 %.

In 2013 the

company is able to improve cash cycle which means the company could run the

business more effective.

In addition, the

company is capitalizing borrowing cost in project of kota kasablanka mall and

tunjungan plaza v.

Recent project

Accordance to

annual report land & building under developments are Grand Island, Edu

City, Palm beach, TP 5 and etc. The future project is tunjungan plaza vI at

east java which will be started in 2015. And Kota kasablanka mall will be

finish in 2015.

Forecast

It

is used the 5 years average growth industry which is on 21 % revenue growth

(source : reuters). The same net additional of fixed asset, cash cycle, gross

margin and etc with 2013 is implemented for 3 years forecast.