Macro economy in

Indonesia

The Central Bank expected GDP

growth in 2013 is approximately at 5.5 % - 5.9 %, this is lower than economic

growth in 2012 which is at 6.2 %. BI Rate at recent is at 7.5 %, it has been

increased from 5.75 % in December of 2012, BI seems continue in conducting

tight money policy until the elections end at 2014. Central Bank expects that

GDP growth in 2014 will in range 5.8 – 6.2 %.

The quality of economic growth

has to be prior concerns. Who are growing reach and who are downing poor? Some strategy has been done such as direct

cash support for the poor citizen who has been done in the last three

years. Each person was given cash

amounting to IDR 300 thousands rupiahs.

Meanwhile Organization for

economic and Development (OECD) in last October that Indonesia’s economy would

grow at an average growth of 6 % during the period 2014 – 2018. I think the

prosperity of Indonesia is still questionable; it depends on the elected

president who will determine policies as the one of key driver of the advancement.

In other side, the nation gets several

volcano disasters at few places, so far it does not ruin significantly.

Based on the data at the last

three years, proven reserves of oil in Indonesia tend to decline. Inversely

with proven reserves of gas, it tends to rise. According to ministry of energy

and mineral resources the energy supply in 2012 amounted to 1,776 million

Barrels. The petroleum based fuel is 13.83 % of total energy mix and the

Natural gas is 23.18 % of total energy mix. Natural gas will be more dominated

than oil in the future.

In 2012 Indonesian upstream oil

and gas business executive board is dissolute by the constitutional court based

on its resolution no. 36/PUU-x/2012 on 13rd November 2012. The government made

new council, the Provisional Executive Work Unit (SKSP Migas). That event did

not affect all contracts which are called as PSC as existing contracts.

Key Driver

The contracts of Pertamina are

the main source of revenue. Pertamina

has 41 % share of PT. Elnusa. Pertamina is Oil Company which is owned by

government and it has many oil and gas projects in Indonesia. The growth of the

company depends on performance of pertamina. Pertamina also has many affiliates

such as Patra Niaga, pertamina E & P, pertamina hulu and etc.

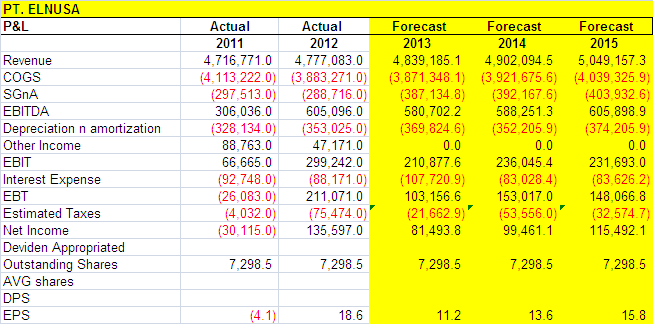

In 2011 – 2012 the company

performs its growth with 1.3 % up in its revenue. The slow growth is affected

by the number of oil and gas projects in 2012.

In 2011 -2012 the company has

available cash more than 10 % of its sales. It means the company tends to

allocate the cash in to the Bank as time deposit, call deposit and saving

account. It seems they has no new project yet which need fund to be allocated

in.

I adjust that the company will

able to increase its sales with the same growth because there are no new

reserves found. Its revenue will come from repeated order from existing

project..

No comments:

Post a Comment